A nearly 3,000-acre $240 million solar project is one step closer to being located in northeastern Hopkins County. The Dike location is one of many international company Alpin Sun is considering in the United States.

The project is contingent on receiving tax incentives from four local taxing entities: Sulphur Springs and Sulphur Bluff school district, Hopkins County and the county hospital district.

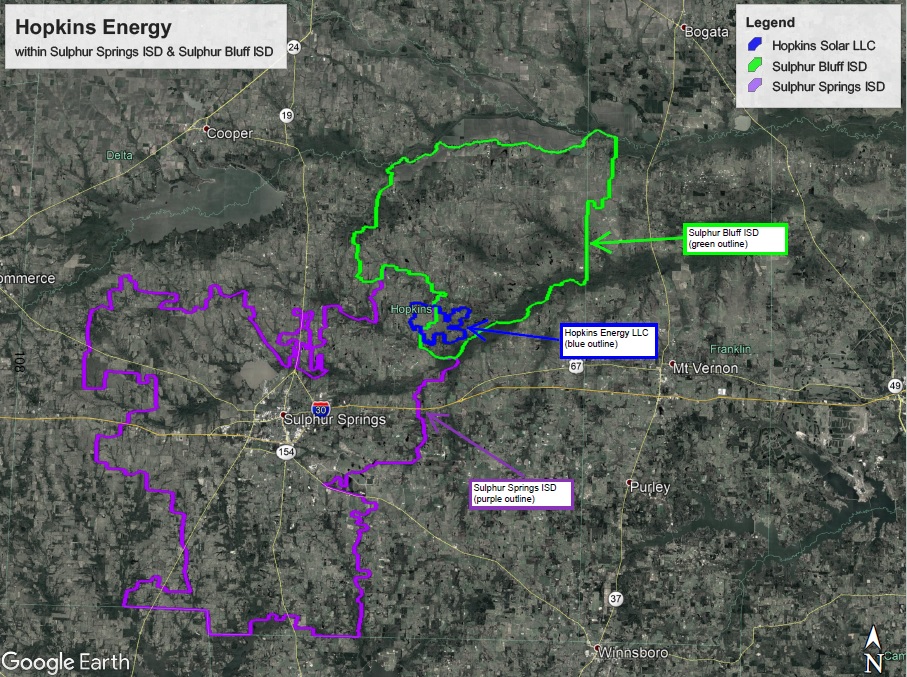

Sulphur Springs ISD trustees on June 10 accepted an application to agree to consider a value limitation for the 40 percent of the proposed facility to be located within the school district boundary and hired Powell Youngblood & Taylor to assist the district with legalities of the project.

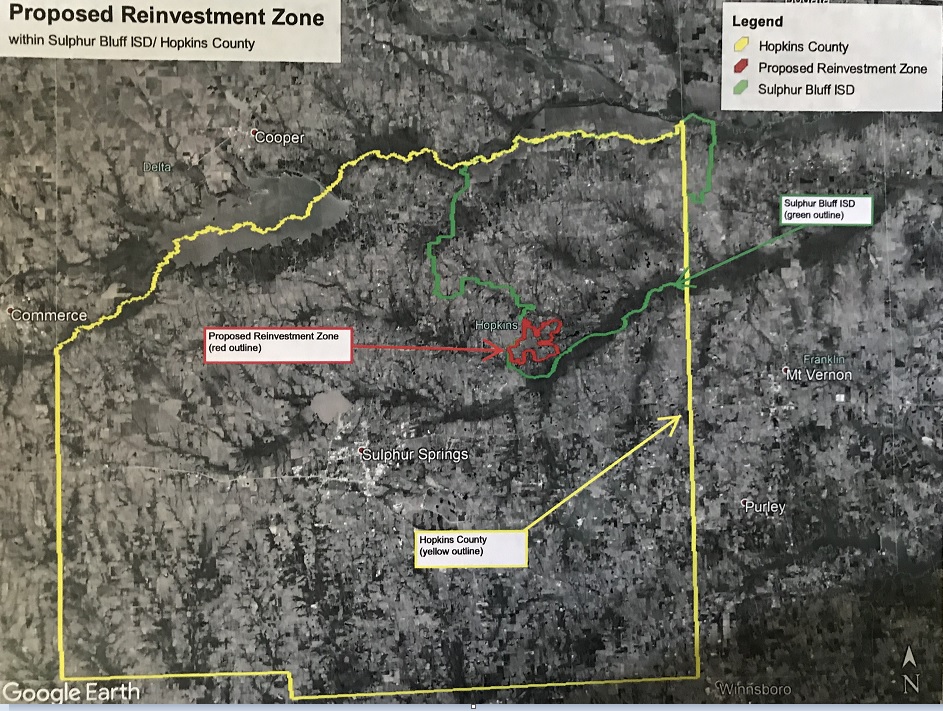

Sulphur Bluff ISD Board of Trustees Thursday, June 20, accepted an application for an appraised value limitation for Hopkins Energy LLC and also hired the attorneys to represent them.

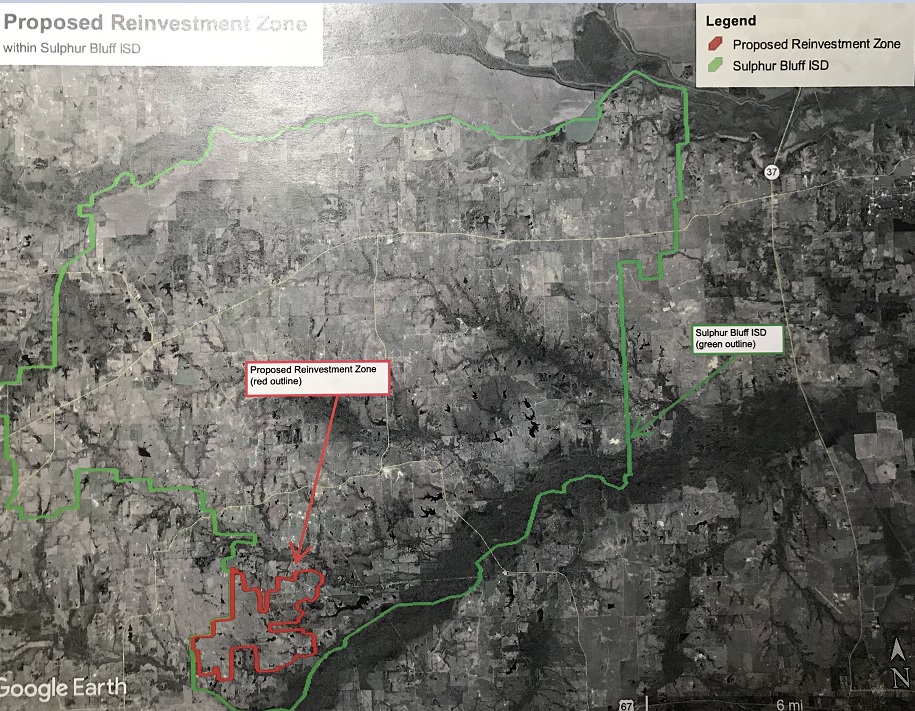

The proposed solar energy project which would span approximately 2,962 acres, with 40 percent in SSISD and 60 percent or an estimated 1,777 acres within SBISD.

The facility is expected to be 320 MW-AC solar electric generating facility, with 1,625,000 photovoltaic panels and 140 inverters. Of those, 192 MW-AC of the capacity, 975,0000 photovoltaic panels and 84 central inverters would be located in SBISD, according to Jordan Christman, property tax incentive coordinator for KE Andrews, the firm for Alpin Sun, which is seeking Chapter 313 value limitations from for Hopkins Energy LLC.

In addition to solar modules and panels and inverter boxes, the project would also have meteorological equipment and operation and maintenance building, electrical substations, associated towers, racking and mounting structures, combiner boxes, foundations, a generation transmission tie line, interconnection facilities and roadways, paving and fencing.

If all taxing entities sign off and the project moves forward, the project is expected to begin construction in 2020 and be complete in Dec. 1, 2021. SSISD on June 10 accepted the application to start the process to consider a tax limitation agreement.

The district agreed to accept an application to be submitted to the state comptroller to be evaluated to determined whether it meets terms for a potential value limitation agreement for Hopkins Energy LLC. The project is expected to be $240 million, with $144 million located in SBISD. The applications asks for a tax limitation of $20 million starting in the 2022-23 school year and continuing for 10 years; that is taxing only that much of the $144 million value. The actual value of the project (in SBISD) is expected to be drop to just over $29 million for years 10-20 of the project, then would drop just below $28 million; the full amount would be taxable starting in year 11 of operation. The lifespan of the project is projected at 30 years, with the company paying full taxable amount to the school district in years 11-30, according to the information presented at the June 20 SBISD Board meeting and in the value limitation application.

Hopkins Energy LLC is also asking for an 80 percent tax incentive from the county and hospital district for the first 10 years of the project as well. For the county that would be a reduction from an annual tax levy of $839,855 down to $167,971; the hospital district’s levy would go from $336,000 annually to $67,200 annually, according to the application presented to the school district June 20.

The taxing entities will also be asked to waive the minimal 10 job requirement for projects seeking the value limitation.

The construction process would provide approximately 300 jobs. Once the facility is complete only three employees would be needed to maintain the entire project, two of which would be located in SBISD. Wages are required to be 110 percent of the average manufacturing wage. That’d be about $43,000 a year for the three full-time employees after the facility is operational, according to Christman.

Also proposed to SBISD is for Hopkins Energy LLC to pay a PILOT or supplemental payment to the school district. The amount is limited to $100 per Average Daily Attendance per year or $50,000, whichever is the greater value. For SBISD, that’s expected to be $50,000, as the district had an enrollment of 234 students at the end of the school year and had peaked at 241 during the PEIMS reporting period, according to information provided by Rick Lambert and Shelly Leung with Powell, Youngblood & Taylor.

Any M&O revenues the district loses as a consequence of the agreement would have to be reimbursed to the district by the energy company, according to the information provided by Lambert and Leung.

Part of the application process required a $75,000 application fee to cover costs for attorneys to review the application which is being submitted to the comptroller’s office and negotiate on behalf of the district an agreement if approved, as well as fund two economic impact studies (one performed independently on behalf of the district and the other by the comptroller) and other costs associated with the application process. Thus, the school districts should not be out any funds during the application process, Christman, Lambert and Leung assured SBISD trustees Thursday.

The measure received approval from all four board members present at Thursday’s meeting — Chris Bassham, David Caldwell, Donnie Powers, Terry Goldsmith.