Sulphur Springs City Council has a full agenda tonight (Sept. 7, 2021), with numerous financial items to be considered, including the proposed budget, tax rate, city utility fees, permit fees, asset forfeiture and EDC budgets, The agenda also includes a rezoning request, utility easement request, bids for water materials for the College Street road project, and resolutions for playground equipment for Pacific Park and four requests for 380 agreements.

Budget and Tax Rate

Ordinance 2783 is an appropriations ordinance for the 2021-2022 fiscal year and Ordinance 2784 sets the tax rate for FY 2021-22. The tax rate is factored based on a 9 page formula set by the state, which can be viewed by clicking here. The City Council is slated prior to these items to hold a public hearing prior to these items to give community members who have questions or wish to address the city officials regarding the tax rate to do so.

The proposal tax rate is just over 1-cent lower for the 2021-22 tax year. That means instead of being charged $0.44 per $100 property value, Sulphur Springs taxpayers will be charged $0.42692 per $100 property value, with $0.06451 of the tax rate designated to go toward debt service and the remaining $0.36241 to go toward maintenance and operations expenses, according to the 2022 Proposed Budget, which the city will also consider at the Sept. 7 meeting.

While the tax rate is a little bit lower, that does not, however, mean that tax bills will be lower. Most property values are appraised higher this year which, depending on the appraised value of the property, likely will mean taxpayers’ city property tax bill will still increase. The tax rate is derived using the formula assigned by the state. While the City Council sets the tax rate, within the established parameters, the elected city board does not have any say in appraisals, which are conducted by the Appraisal District or their designees.

GENERAL FUND REVENUE- PROPERTY TAX FY 2018-19 Per $100 Property Valuation FY 2019-20 Per $100 Property Valuation FY 2020-21 Per $100 Property Valuation FY 2021-22 Per $100 Property Valuation (Proposed) Maintenance & Operation $0.38260 $0.37204 $0.36713 $0.36241 I&S (Debt Service) $0.057400 $0.067960 $0.072370 $0.64510 Property Tax Rate Per $100 Valuation $0.44000 $0.44000 $0.44000 $0.42692

The rate will raise $507,107 more in total property tax revenue than last, an 11.3 percent increase, with $52,715 in tax revenue coming from new property added to the tax roll over the last year, according to the proposed budget information posted for review.

For instance, the taxable value on an average homestead in Sulphur Springs was estimated at $105,229 in the 2020-2021 tax year, but would be $115,012 in tax year 2021-2022That’d increase the tax bill for the average homestead by about $28, from $263.01 in 2020-21 to $491.01 in 2021-22, according to the Notice of Public Hearing on Tax Increase (an increase in overall tax revenue, not tax rate) posted in August by the City of Sulphur Springs.

Also to be discussed and considered are the asset forfeiture budget, Economic Development Corporation Budget. The city budget and tax rate, will be read for the first time at the 7 p.m. meeting Sept. 7, at Sulphur Springs Municipal Building, then presented again later in the month at another special council meeting for second reading and final approval.

City Utility Rates

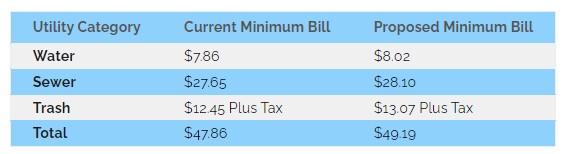

Three other ordinances as proposed would increase and set the city’s water, sewer and sanitation rates by an estimated $1.33 per city utility bill for residential customers. That would raise the minimum city utility bill from $47.86 to $49.19 per month for residential customers, as proposed.

The monthly water demand charge would increase from $7.86 to $8.02 for those with water meters less than four inches in size with a monthly demand charge plus a charge of $4.05 for each 1,000 gallons of metered water. Monthly water rates for active connections with the system with meters 4 inches or larger would be set at a minimum $939.52 for 0-230,000 gallons of water, with an additional fee of 3.78 per 1,000 gallons of water for all usage above 230,000 gallons. (see page 110 of the 2022 proposed budget to view Ordinance No. 2785 setting the water rate)

Ordinance No. 2786 (page 112 of the proposed city budget) would increase sewer rates from $27.65 to $28.10, for 0-4,000 gallons usage, and $4.07 per thousand gallons usage for over 4,000 gallons, figured based on water consumption. The proposed 2 percent sewer rate increase would help keep up with inflation, which has increased the cost the city pays for chemicals, materials and employee wages to treat wastewater, city officials reported at an August budget work session.

Ordinance No. 2787 (pages 112-113 in the proposed city budget) would increase the city sanitation rate (trash service) 5 percent, from $12.45 plus tax to $13.07 plus tax for hand collection of trash twice a week for each dwelling unit, multi-family residences for each unit, and mobile home park for each unit counted in the park. The monthly charge for commercial collection would be $26.15 per commercial unit. Business rates would be billed per yard from 3-8 years based on frequency of collection weekly. For a temporary dumpster, one used for less than 6 months), a $102.84 delivery fee would be charges as well as any other pass through fees charges. Assistant City Manager/Finance Director Lesa Smith explained that the City of Sulphur Springs’ contracts with Sanitation Solutions and Republic Services; their contracts allow for the two companies to adjust the rates charged to the city by the CPI in October of every year. As of June 30, 2021, that amount was up 6.1 percent from June 2020. Last year, the contracted prices increased by 1.3 percent, but the city did not increase customer rates.

The City Council too will be asked at the 7 p.m. meeting Sept. 7, to consider approving on first reading ordinances setting these rates, and another establishing a master fee schedule of costs, fees and rates associated with permitting, utility services and other services provided by the city. The ordinances, if approved, would be presented again at a meeting later in the month for second reading and final approval.

Other items

The City Council will also be asked to consider four 380 agreements, one each for property at: 219 Craig Street, 447 Houston Street, and Lots 3R and 1R at 410 Houston Street.

Bids are expected to be considered and a contract potentially awarded for water materials for the College Street road project, adopting an annual investment policy; an easement with Oncor Electric Delivery LLC at Coleman Park Water Tower; an ordinance to rezone Lot 10 A of Town Addition at 618 Oak Avenue from multifamily (a house) to light commercial, for future business use; authorize updated service credits; final reading of a request to rezone the 1.89-acre Lot 3R-3 at 125 Weaver Drive from heavy industrial to multifamily, for potential future residential development on the site; and playground equipment for Pacific Park.