Proposed tax rate, budget, rates for city services and personnel policy for the City of Sulphur Springs; and the EDC budget and plan of work are among the items on Tuesday evening’s regular City Council agenda.

After budget work sessions with the City Council over the past few months, city officials anticipate presenting during the 7 p.m. Sulphur Springs City Council for council consideration a proposed budget, tax rate, and rates for sewer, water and sanitation services. Longevity and certificate pay, and insurance too are factors to be discussed at the 7 p.m. meeting tonight (Tuesday, Sept. 6, 2022) in the Council Chambers at City Hall.

The overall proposed budget is projected to be balanced, and include a 9% cost of living adjustment for city employees. That’s almost as high as the price of inflation which had peaked at 9.3% in May on the consumer price index, but ahead of the CPI average of 8.08% from October 2021 to March 2022.

Sales tax largely mimics CPI, but that only applies to the general fund. Utility, airport and tourism fund revenues only increase when fees increase and/or volume increases, Assistant City Manager/City Finance Director Lesa Smith explained during one August budget work session. A COLA increase of just 1% per fund would add $96,739 to the overall budget. Increased sales tax revenue in the general fund and lower debt payments in both general and enterprise funds make the 9% increase and $10 longevity pay possible. Anything over that, however, would require increased utility rates and increased airport fees.

While Capital Improvement Plan is adopted on a pay-as-you-go budget, the city’s cost to provide water to users increased 9.8%. As proposed, all event and promotion activity will be moved to the tourism department, where previously the functions were managed between downtown and tourism.

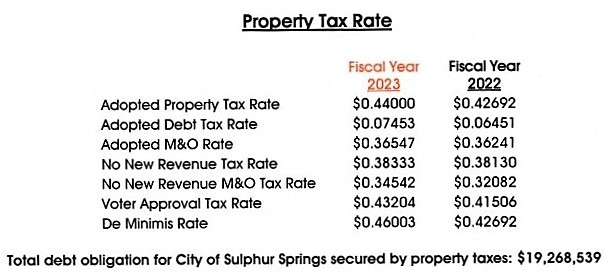

The proposed tax rate, using the required state formula, is $0.44 per $100 property valuation. While above the no-new-revenue tax rate of $0.38333 per $100 and voter-approval rate of $.43204, it’s still below the de minimis rate of $0.46003 per $100. The de minimis rate is the rate equal to the sum of the no-new-revenue maintenance and operations rate for the City of Sulphur Springs, the rate that will raise $500,000, and the current debt rate for the City of Sulphur Springs.

The 20% homestead exemption policy adopted by the city would cause the average taxable value of a homestead in the city to decrease by $13,126, for eligible tax payers. The total tax per $100 value increases by ($0.01308 per $100) from $0.42692 from 2021 to 44-cents for tax year 2022. Factoring in an 11.41% decrease, the average homestead taxable value decreases from $115,012 to $101,886. So the tax on the average homestead would decrease from $491.01 to $448.3 (down $42.71). The average tax levy on all properties would increase from $5,070,777 to $5,570,442, the assistant city manager said when presenting projections at an August work session.

Overall, the new tax rate is expected to raise $401,593 more from property taxes, an 8.4% increase from the previous year’s budget, with $92,174 to be raised from new property added to the tax roll this year.

Before the budget and tax rate are presented for consideration on first reading, a public hearing will be conducted for each as well as an ordinance presented on second and, if approved, final reading that will allow the City of Sulphur Springs to charge mitigation rates for costs incurred during deployment of emergency and non emergency services, equipment and first responders by the city fire department to assist individuals who are not residents of either Sulphur Springs nor Hopkins County. An agreement with a group to help with billing and accounts receivable management for municipalities or governmental entities too is proposed for consideration.

A second public hearing will be conducted Sept. 20 for second reading and adoption of hte budget and to set tax rates.

Additional ordinances proposed for second, and if approved, final approval include Ordinance 889, which updates the city’s ordinance regarding authorized locations of videogaming facilities, premises and devices.

Ordinances No. 2813, 2814 and 2815 which would set the water, sewer and sanitation rates are to be presented on first reading for consideration by the City Council. The Sept. 6 agenda also includes for discussion and possible action:

- master free schedule for costs, fees and rates associated with permitting, utility and other city services;

- updated service credits; Sidewalk Committee appointments;

- asset forfeiture budget; bids for a bar screen and chemicals at the wastewater treatment plant;

- chemicals for the water treatment and wastewater treatment plants;

- agreement with Vail & Park, P.C. for FY 2022 audit services;

- EDC budget and plan of work;

- an amendment to the land sale agreement with Ashoka Steel, Inc., to acquire a portion of the old Thermo mine property to set up a new plant to make rebar using recycled materials;

- and a negotiated settlement between between Atmos Cities Steering Committee and Atmos Energy Corporation; and

- required annual review of investment policy.

The City Council will meet 30 minutes prior to the regular open session to consult with an attorney and deliberate on economic development for Ahsoka Steel.

The proposed city budget and tax rate can be found on the City’s website; click here for a direct link. Proposed ordinances