Early voting got off to a slow start Monday, with a total of 20 ballots cast during the first day of early voting in the Constitutional Amendment, North Hopkins ISD trustees and Cumby City Council Elections.

Early Voting

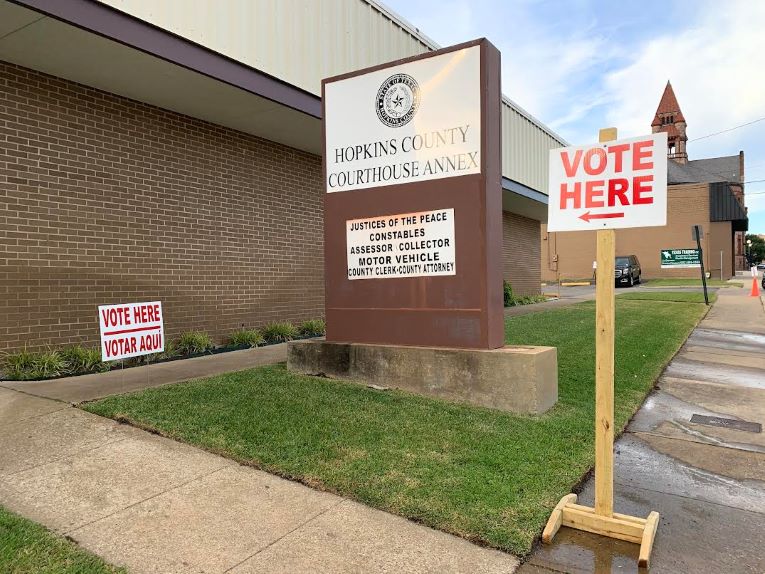

All early voting by personal appearance is being conducted from 8 a.m. to 5 p.m. Friday, Oct. 29, 2021, in the Hopkins County Justice of the Peace #2 Courtroom, located inside the Hopkins County Annex Building at 128 Jefferson St., Suite C. Two days have been designated for extended early voting hours. Ballots may be cast early by personal appearance in the three elections from 7 a.m. to 7 p.m. Tuesday, Oct. 26, and Thursday, Oct. 28, 2021.

Applications for ballots by mail must be received no later than the close of business on Oct. 22 by the Early Voting Clerk, Tracy Smith, at 128 Jefferson St., Suite C, Sulphur Springs, TX 75482. Federal postcard applications must be received no later than the close of business on Oct. 22. Voted ballots by mail must be received by the Early Voting Clerk (Smith) no later than 7 p.m. Tuesday, Nov. 2, 2021.

Election parking is available across the street from the County Clerk’s Office on Rosemont Street.

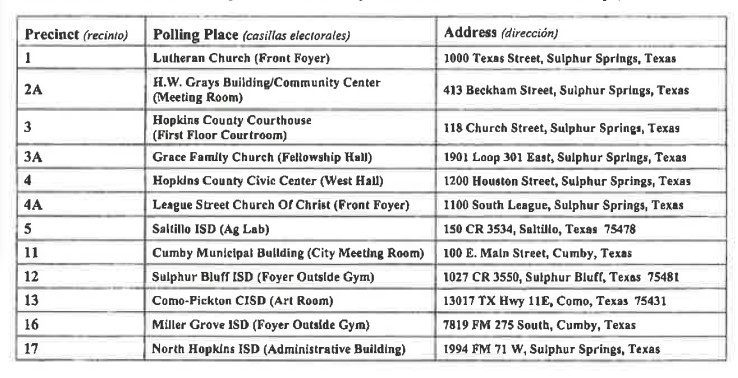

Election Day Voting

On Election Day, Nov. 2, 2021, voters may cast ballots from 7 a.m. to 7 p.m. at any of the 12 designated voting locations:

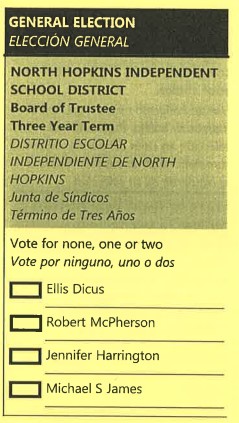

North Hopkins ISD Election

Hopkins County voters who reside within North Hopkins ISD will be asked to choose up to two candidates to fill two trustees seats on NHISD Board of Trustees. Candidates are selected at large, so the two candidates receiving the most votes will be elected to the serve a full three-year term on the school board.

Candidates for the school election include Ellis Dicus, Robert McPherson, Jennifer Harrington and Michael S. James.

The NHISD General Election appears after the eight Texas Constitutional Amendments on the sample ballot.

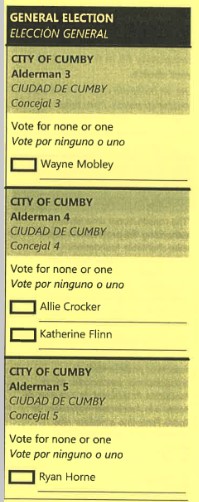

Cumby Election

The City of Cumby will not only have a General Election for Alderman Places 3, 4 and 5 on the City Council. The Council had originally called for a Special Election to fill Alderman Places 1 and 2 on the City Council as well, but reportedly canceled it due to lack of candidates

The Cumby General Election is listed at the end of the ballot. Neither Wayne Mobley nor Ryan Horne drew challengers for another term on the City Council, thus, Mobley is the only candidate for Alderman Place 3 and Horne the lone candidate on the ballot for Alderman Place 5 on Cumby City Council.

Cumby voters will be asked to choose between Allie Croker and Katherine Finn for Alderman Place 4 to also serve a full term on the City Council.

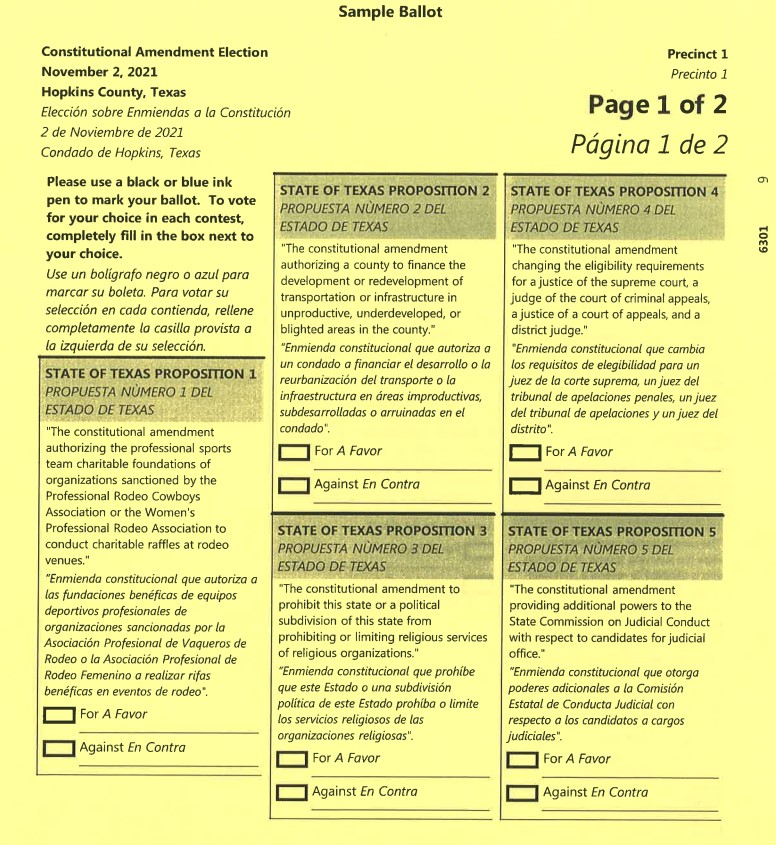

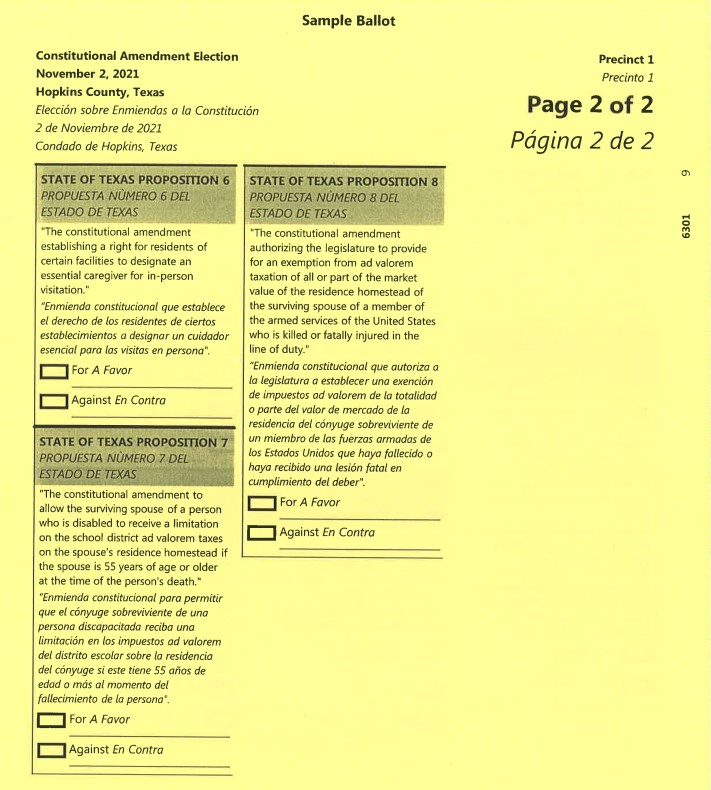

Constitutional Amendments Election

All registered Hopkins County voters also have the opportunity to select their choices on eight Texas Constitutional Amendment Propositions. Voters will be asked to vote either for or against the following propositions:

- Proposition Number 1 – HJR 143 proposes a constitutional amendment expanding the circumstances in which a professional sports team charitable foundation may conduct raffles to raise money for the foundation’s charitable purposes. The proposed amendment would allow professional sports team charitable foundations of organizations sanctioned by the Professional Rodeo Cowboys Association or the Women’s Professional Rodeo Association to hold charitable raffles at rodeo events.

- Proposition Number 2 – HJR 99 proposes a constitutional amendment allowing the legislature to authorize a county to issue bonds or notes to finance the development or redevelopment of an unproductive, underdeveloped, or blighted area within the county and to pledge for repayment of those bonds or notes increases in property tax revenues imposed on property in the area by the county. The Texas Constitution gives the legislature the power to authorize an incorporated city or town to issue such bonds or notes but does not expressly give the legislature the power to grant that same authority to counties. The proposed amendment also provides that a county that issues bonds or notes for transportation improvements may not pledge for the repayment of those bonds or notes more than 65 percent of the increases in ad valorem tax revenues each year, and a county may not use proceeds from the bonds or notes to finance the construction, operation, maintenance, or acquisition of rights-of-way of a toll road.

- Proposition Number 3 – SJR 27 proposes a constitutional amendment barring the State of Texas or a political subdivision from enacting, adopting, or issuing a statute, order, proclamation, decision, or rule that prohibits or limits religious services. The proposed amendment would apply to religious services, including those conducted in churches, congregations, and places of worship, in the state by a religious organization established to support and serve the propagation of a sincerely held religious belief.

- Proposition Number 4 – SJR 47 proposes a constitutional amendment changing certain eligibility requirements for a justice of the Supreme Court, a judge of the Court of Criminal Appeals, a justice of a court of appeals, and a district judge. The proposed amendment provides that a person is eligible to serve on the Supreme Court if the person, among other qualifications, is licensed to practice law in Texas; is a resident of Texas at the time of election; has been either a practicing lawyer licensed in Texas for at least ten years or a practicing lawyer licensed in Texas and a judge of a state court or county court established by the legislature for a combined total of at least ten years; and during that time has not had the person’s license to practice law revoked, suspended, or subject to a probated suspension. The same eligibility requirements would apply to a judge of the Court of Criminal Appeals and to a justice of a court of appeals. The proposed amendment further provides that to be eligible for appointment or election as a district judge, a person must be a resident of Texas; be licensed to practice law in Texas; and have been a practicing lawyer or a judge of a court in Texas, or both combined, for eight years preceding the person’s election, during which time the person’s license to practice law has not been revoked, suspended, or subject to a probated suspension.

- Proposition Number 5 – HJR 165 proposes a constitutional amendment allowing the State Commission on Judicial Conduct (SCJC) to accept complaints or reports, conduct investigations, and take any other authorized action with respect to a candidate for a state judicial office. Currently, the Texas Constitution only permits the SCJC to take such actions as to persons holding a judicial office.

- Proposition Number 6 -SJR 19 proposes a constitutional amendment establishing that residents of certain facilities have the right to designate an essential caregiver with whom the facility may not prohibit in-person visitation. The proposed amendment would apply to a nursing facility, assisted living facility, intermediate care facility for individuals with an intellectual disability, residence providing home and community-based services, or state supported living center. The proposed amendment also would authorize the legislature to provide guidelines for these facilities to follow in establishing essential caregiver visitation policies and procedures.

- Proposition Number 7 – HJR 125 proposes a constitutional amendment permitting a person who is 55 years of age or older at the time of death of their spouse who is receiving a limitation on school district property taxes on their residence homestead on the basis of a disability to continue receiving the limitation while the property remains the surviving spouse’s residence homestead.

- Proposition Number 8 – SJR 35 proposes a constitutional amendment authorizing the legislature to exempt from ad valorem taxation all or part of the market value of the residence homestead of the surviving spouse of a member of the United States armed services who is killed or fatally injured in the line of duty. The Texas Constitution provides a property tax exemption to the surviving spouse of a member of the armed services who is killed in action, but the current exemption does not include members of the military who die during their service due to injuries sustained that are not combat-related.