The Board of Directors this week approved a 3-cent reduction in the Hospital District Tax Rate for 2021-2022, and a budget during a special called meeting this week.

2021-22 Tax Rate

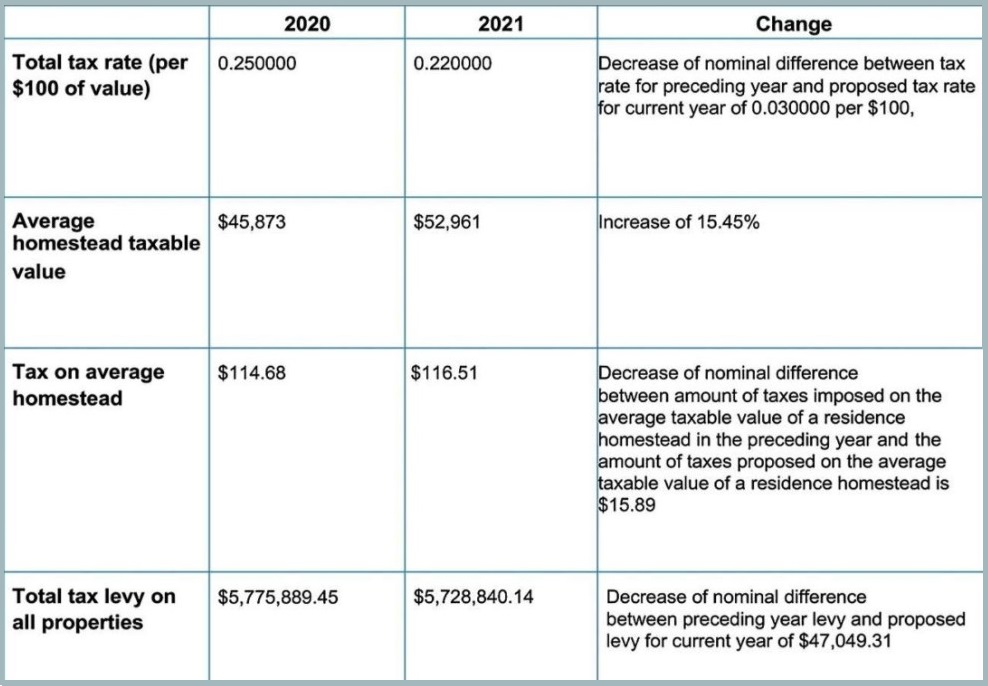

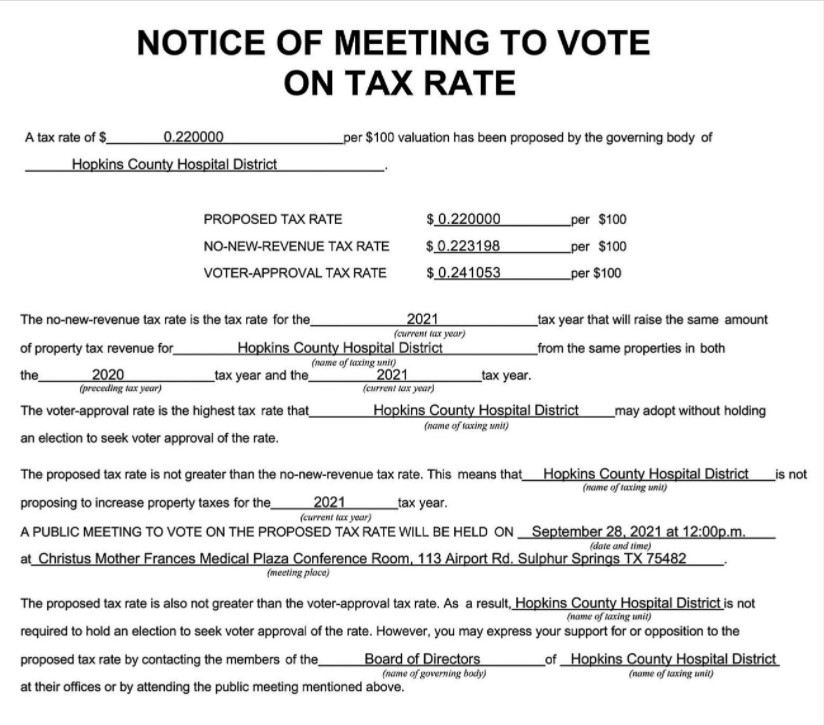

The hospital district tax rate will be 22-cents per $100 property valuation, down from 25-cents.

However, due to a 15.45 percent increase in appraisal values on the average taxable homestead value, property owners will likely see an increase in their tax bills. In other words, if the taxable value on a homestead in 2020 was $45,873, that homestead value in 2021 would increase to $52,961. The tax then on the homestead would increase by almost $2 from $114.68 to $116.51 in 2021 tax bills, according to the tax notice posted on the HCHD webpage.

The overall total tax levy on all properties within HCHD has decreased slightly, however, from approximately $5.78 million to $5.73 million, according to the public notice posted by HCHD Board earlier this month. That’s a $47,049.31 decrease in overall tax revenue, according to the public notice posted on the Hospital District webpage.

With no one from the public attending to speak during the designated public forum, the tax rate was unanimously approved by the board members present at the Sept. 28, 2021, special called board meeting.

FY 2021-22 Budget

The Hospital District Board too approved the budget, which includes $5,728,840.14 derived from projected tax revenue.

When asked by HCHD Board member Joe Bob Burgin about the lack of capital expenses in the proposed budget, HCHD COO/EMS Director Brent Smith said the budget did not include any capital expenditures, as the board had already approved the major cost of an ambulance at a prior meeting.

“The only capital request that we will ask for in the future will be closer to the time the [new EMS station/HCHD] building is complete are for items that need to go in that building,” Smith affirmed.

“Furniture and that kind of stuff?” HCHD Board President Kerry Law asked.

“Yes,” Smith affirmed during the Sept. 28 noon meeting.

“Ya’ll seem to always need a bunch of capital and I just want to make sure we are all on the same track,” HCHD Board member Joe Bob Burgin said.

“I try to look 2 to 3 years out. We’re in good position right now,” Smith noted.

“The last 2-3 months of hte budget, that stuff will be place din service, and it’ll start to depreciate once we put it in service. That’ll be in the fourth quarter of our fiscal year, most likely,” Law said.

“We can buy cardboard boxes ’til the next fiscal year,” Burgin said jestingly.

The budget for FY 2021-22 which began Oct. 1, 2021 and ends Sept. 30, 2022, is projected to bring in $11.88 million in revenues, including the tax revenue and funds collected for rental services and EMS bills, and $7.83 million in expenses for EMS.

The district anticipates receiving another $15,996 in Texas fuel tax refunds, about $1,333 per month.

The budget too includes $4.5 million monthly in nursing home revenues, for a total of $54 million in nursing home revenue. Nursing home expenses are projected to be $4.4 million per month, or $52.8 million per year. That should mean about $1.2 million coming back to the hospital district.

The district too expects to spend $166,666.67 monthly for indigent care per their agreement, for a total of $2 million in indigent care expenses projected. So, $65,333.67 monthly, or $784,004 annually will need to come from other revenue sources to fund the obligation.

That should leave $499.484.12 after all expenses every month, or $3.27 at the end of the year once all expenses and revenues are reconciled, according to the summary provided by HCHD administration this week.

Other Business

Law said he likes the balance sheet and statement of cash flows as presented in the district financial statements, but would like to see an income statement that rolls the district and all the EMS into what is the bottom line for the entirety of the district.

“Right now, you can see what the district does, then you’ve got to add Hopkins County [EMS] to it, then you’ve got to add the other 3 districts [Delta, Franklin and Rains County EMS] to it to get to a real bottom line,” Law said of the 2020-21 financial statements.

Not counting the sale of hte district’s share in CHRISTUS Hopkins Health Alliance, HCHD’s financials as of August 2021, were $3.97 million

“I was trying to get to what does this year looks like compared to what was budgeted. So I would say, that budget is probably a reasonable look at $3.2 million and some change. And we are sitting at $3.9 million. The balance sheet is pretty clean,” Law noted.

The board too discussed the depository bid process. and opted to post notices three consecutive weeks to start the process. The board last had to post notices seeking interested financial institutions for hospital district finances in 2016, staff reported.