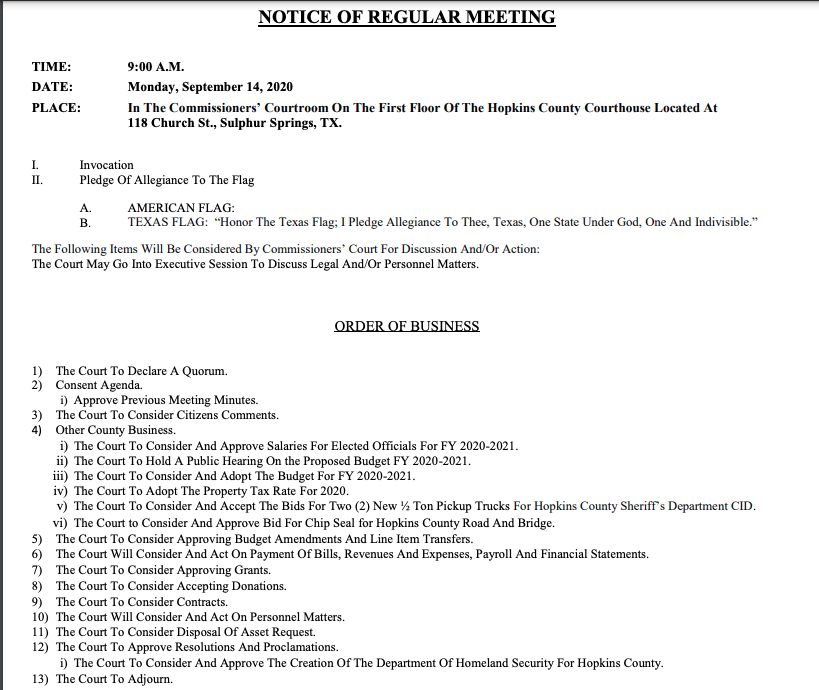

2 Citizens Voice Concerns, Opinions During Public Hearing For County Tax Rate

Hopkins County Commissioner Court will be asked Monday, Sept. 14 to consider adopting a proposed tax rate. Prior to that, counties are required to hold public hearings to allow county residents to voice concerns or questions regarding the proposed tax rate to the Commissioners Court. During the second tax hearing, two citizens expressed their displeasure with the current tax structure and and impact of increased tax bills.

Proposed Tax Rate

The proposed tax rate to be considered next Monday morning by the Commissioners Court is $0.624892 per $100 property value for the 2020-21 tax year, according to Hopkins County Tax Assessor/Collector Debbie Mitchell.

The tax rate is figured based on Senate Bill 2, which changed some factors in the way tax rates are calculated. The template used to determine the calculation for the tax rate is more complicated than in past years, requiring several additional steps, according to Mitchell.

The effective or “no new revenue” tax rate for Hopkins County is $0.598662. This is the tax rate the county would need to bill at in order to collect the same amount of tax revenue in 2020-21 as in the 2019-2020 tax year.

The voter approval rate is $0.626583. Formerly the rollback rate, the voter-approval rate is a figure set by the state, an amount of increase in tax roll growth under which the county must remain.

A Hopkins County tax rate of $0.624892, according to the proposed budget posted on the county website, should generate an additional $425,410 in revenue from property taxes in the 2020-21 tax year, compared to the 2019-2020 tax year, including $366,995 in tax revenue from new property added to the tax roll this year. That means although the tax rate will remain the same, some taxpayers will pay more in taxes due to increased appraisal values. Appraisal values are set by the Appraisal District, a separate entity, not by the Commissioners Court.

Hopkins County Judge Newsom noted the proposed $0.624892 tax rate is below the set amount the Legislature determined the county cannot exceed. It is the same tax rate the county has adopted for the last three years.

The proposed 2020-21 budget includes a 2 percent pay increase to all employees and elected officials as well as an additional $25 a year longevity.

The Sept. 14 Commissioners Court meeting will begin at 9 a.m. in the Commissioners Courtroom on the first floor of Hopkins County Courthouse, 118 Church St. in Sulphur Springs. In addition to the tax rate, the Commissioners Court will hold a public hearing for the 2020-21 budget, and consider approving salaries for elected officials and approve the budget.

Public Hearing

Hopkins County residents Jerry Lamb and Lawanda Knight Kent both shared their opinions, suggests and concerns to the Commissioners Court during the 9 a.m. court session of Sept. 8.

“Today, over 29 million people are collecting unemployment. Times are tough and getting tougher, yet the county is getting $425,410 in property tax, $366,995 in new property,” Lamb said. “Once the total budget is passed, how much is left in the general fund?”

Newsom said they don’t have those figures for this year yet. The county auditor said she could give a projection, but didn’t have the exact figures on hand at the Sept. 8 meeting and won’t have final figures until the fiscal year ends on Sept. 30.

“It’s about $4.8 [million]. We have a policy that we won’t allow the fund balance to go any lower than $4 million,” Auditor Shannah Aulsbrook said.

Lamb questioned wanted to know why the county doesn’t have “6 months operating emergency funds set aside for when the pendulum swings the other way?”

He asked why each commissioner is allocated the same starting funding, while operating costs and line item expenditures are different in each commissioner’s budget.

Lamb expressed concern for the descendants of the original settlers of the county, who, he said, are “getting pushed out” and are having to sell property that’s been in their family for over 100 years because they can’t afford to pay the property taxes.

“The person who owns pasture land that borders my property on one side has had his property resurveyed and broken up into several plots and as I understand it already sold one, consisting of just a few acres because he could no longer afford taxes on property owned by his family for many years,” Lamb noted.

Lamb said there seem to be three types of property owners/taxpayers who are buying property around him in Hopkins County, residents of other states who purchase property and build $500,000-$600,000 homes, which drives up property values around it; “average folks” who are retiring or looking for a new start outside of larger cities; and people who are “busted, broken down with nothing left.”

“Hundreds of acres have changed hands in the past couple of years. Sadly, the last group has it the hardest,” Lamb said. “The first experience I observed was the purchase of just a few acres, 3 or 4 acres, and total woods where a small area was cleared and a tent appeared. People are living in tents. A second tent appeared, then a third, then a small travel trailer, several vehicles. The area looks now like a homeless encampment.”

Seeing that change and property-owners’ struggles prompted Lamb to study the county budget, looking for areas where perhaps county could be reduce, which could potentially be passed on to property owners, in the form of lower tax rates.

Lamb questioned why all county elected officials get paid the same salary.

Precinct 1 Commissioner Mickey Barker said the salaries were all set that way years ago. Newsom pointed out that the county sheriff gets paid a little bit more overall.

Auditor Shannah Aulsbrook noted that pay varies in some areas due to certificate pay. While the sheriff is paid more, the constables receive a little less.

“Elected officials’ salaries increased almost $4,000 since 2019. Elected officials’ salary in this budget is over $59,000. So, here’s a suggestion to save some money since we taxpayers on fixed incomes don’t get a tax break, we just keep paying out more,” said Lamb, when proposing the Commissioners Court consider and enact a salary step program for the “next 4-year tenure” of all newly elected county officers and any newly elected county employee in any area in which they are not currently employed. The exception, he said, would be the county sheriff.

“I think anybody that walks out the door in the morning and doesn’t know if they are going to be home tonight, alive, puts their life on the line for their fellow man – I believe a first responder deserves more,” Lamb said.

Newly elected officials would not be as knowledgeable about their position as someone with four years of tenure, and likely wouldn’t fully learn the job in one year, Lamb reasoned. He suggested increasing the elected officials’ pay annually on a step scale and, if reelected, starting with the same salary. Doing so, Lamb suggested, could allow the commissioners to use that money elsewhere and give taxpayers on a fixed income a tax break.

“The pendulum is going to swing the other way eventually,”Lamb said. “If you don’t have a good 50 percent backup on your budget, don’t come asking me for more money, because there are no more cookies in the cookie jar folks.”

Lawanda Knight Kent, a proud Hopkins County native who has lived on State Highway 19 for 30 years and still owns the family farm, complained about the the number of taxing entities and the financial burden those taxes place on older residents.

“Taxes have just gone completely berserk,” Kent said, lamenting the many taxes county residents now have to pay, including to schools, the county and hospital district. “And, that does not include your everyday expenses. Now, we can’t give ourselves a raise to pay this. It’s kind of sad to see older people in the store looking at prices, putting many items down because they can’t afford them. You might do well to see that. It’s pretty sad.”

Kent said she isn’t able to vote on either the Miller Grove ISD or Sulphur Springs ISD tax rates, even though she owns property there, because she doesn’t live in either district, but can voice her concerns regarding county taxes. She urged the county commissioners, when they consider giving themselves a pay raise, to remember the older people who can’t afford food.