Miller Grove area residents are being asked to consider approving in the May 4 Miller Grove Independent School District bond election a tax increase to fund a new Multipurpose Center.

The new facility would house a new elementary gymnasium, fine arts facility to include a UIL-compliant stage, concessions and kitchen area, and restrooms. The new MGISD facility would also have space for future expansion of the facility to include classrooms, weight room and locker rooms.

What does that mean for tax-payers?

“If the bonds are authorized, the estimated total tax rate of the District is expected to be $1.46 per $100 of taxable assessed valuation, representing the sum of (i) the most recently adopted tax rate for operations and maintenance, which is $1.17 per $100 of taxable assessed valuation, plus (ii) the estimated tax rate for voted debt obligations of the District, including the bonds, which is estimated to be $0.29 per $100 of taxable assessed valuation,” the Notice of Ballot Election states.

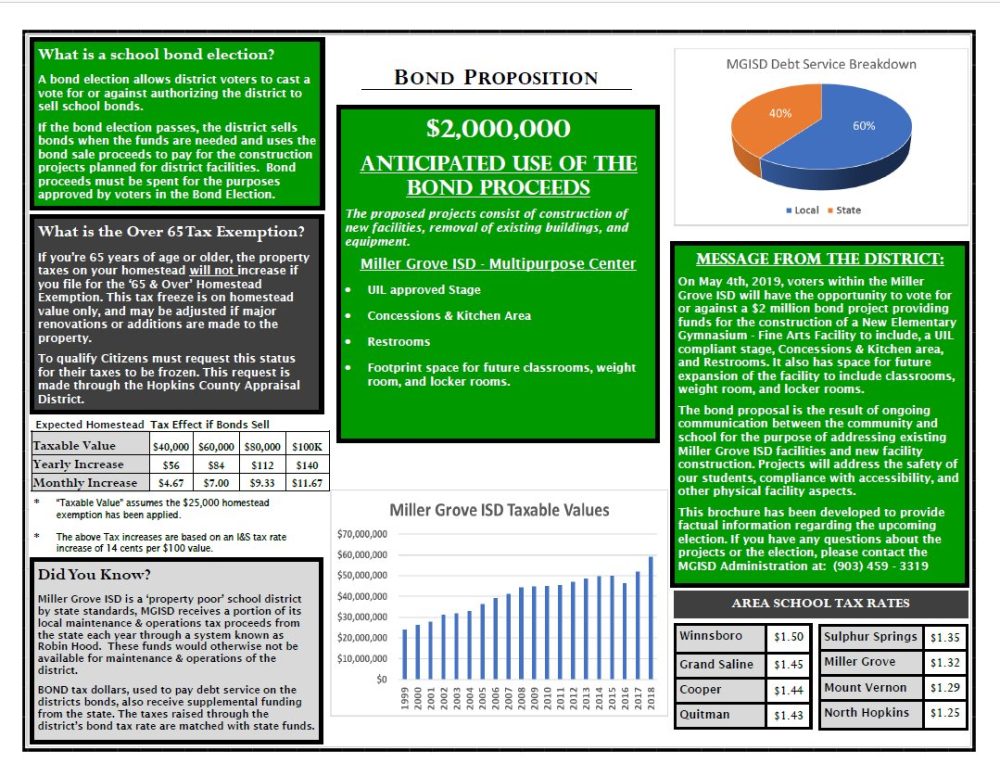

Basically, that means tax payers will pay an additional 14 cents in I&S property tax per $100 property value, raising the I&S tax rate to $0.29, the highest rate the district can set it at and still receive a 40 percent state contribution, according to Johnson.

Because MGISD is considered by the state to be a “property poor” school district, the district is also eligible to receive supplemental funding from the state to apply to bond debts.“The taxes raised through the district’s bond tax rate are matched with state funds,” at a 40 percent state-60 percent district rate.

This will not change the tax on homesteads for MGISD residents who have filed for the “65 and over” homestead exemption; their rate homestead value is frozen, and would only be adjusted if the owner made major renovations or additions to the homestead property. This exemption must be requested through Hopkins County Appraisal District.

If the bond sells, the expected homestead tax on a $40,000 homestead would increase $36 yearly or $4.67 monthly. The homestead tax rate on a $60,000 property would increase $84 annually or $7 per month. A Homestead valued at $80,000 would increase $112 per year, or about $9.33 per month. The tax rate on a $100,000 home would increase $140 per year or about $11.67 per month.

For more information about the bond election and proposed project, visit the MGISD website or contact the MGISD administration at (903) 459-3288.