Chapter 381 Tax Abatements Granted BY HCHD To Pine Forest, Dike solar farms

Hopkins County Hospital District Board of Directors approved Chapter 381 Economic Development Tax Abatements for two solar farms, and selected an architectural firm for a new EMS headquarters/Hospital District Building and a company to demolish three houses on Airport Road.

EMS/District Facility

The requested information was posted seeking qualifications for potential architects to design a new EMS headquarters/Hospital District facility, to replace the current building, which has outlived its life span and is in need of many repairs.

Brent Smith, chief operating officer for HCHD and director of EMS, reported both architects who responded are “very qualified.” He said he would be happy with either BRW Architects or REES to design a new District and EMS headquarters.

Board member Kerry Law asked if either one was more expensive than the other and if Smith had a projected ballpark price for the project.

Smith reported BRW has been recognized in magazines for several national awards for their architectural work. The firm is reported to be a bigger operation, which could potentially cost more, Smith said without more solid plans he could not be certain but anticipates the cost to be around $2-2.5 million.

Smith said he will be attending a conference in May which will help provide additional information regarding architectural design for public safety facilities.

The suitability of the proposed site, near the current location, was discussed. Law noted there to be a pipeline along that area and expressed concern it might present a problem for construction.

Steven Hudson with EST Inc. said it would depend where on the district property the new building is planned. One big factor is that a significant portion of the proposed site is in a flood plain.

Adam Panter is with REES. Panter is originally from Hopkins County and known for his work on a downtown structure as well as a local funeral home and other structured in town. That would make him more familiar with the area and its needs, Hudson and the hospital district officials noted.

Hudson also pointed out that working with REES would also likely mean some jobs going to people in Hopkins County.

Dr. David Black recommended selecting REES for the project based on the local factor and Panter’s past work experience with the community. Law agreed, provide an agreement can be met regarding REES’ fee. The measure passed, with one board member abstaining from voting.

Demolition Work

The Hospital District Board after discussion approved Garrett Demolition of Burleson for demolition of three structures on Airport Road on district-owned property. Garrett’s bid of $37,875 was the lowest of the three received, and also included a pre-demolition asbestos survey but excluded fill dirt. The next lowest bid by Underwood Sand and Gravel was for $46,414 and MS Landscaping bid $68,000, according to HCHD CEO/CFO Ron Folwell.

Attorney Tommy Allison asked if by excluding the fill dirt had Garrett met all specified terms in their proposal.

An asbestos survey will be required and permits stating the area is clean of asbestos, officials noted. If asbestos is found, it would need to be removed prior to demolition. Board member Chris Brown pointed out a state law requiring the asbestos check anytime the property is within 500 feet of a government one.

The board approved Garrett Demolition’s bid, with one abstention, provided the company’s references are verified and the additional top soil cost is considered.

Tax Abatements

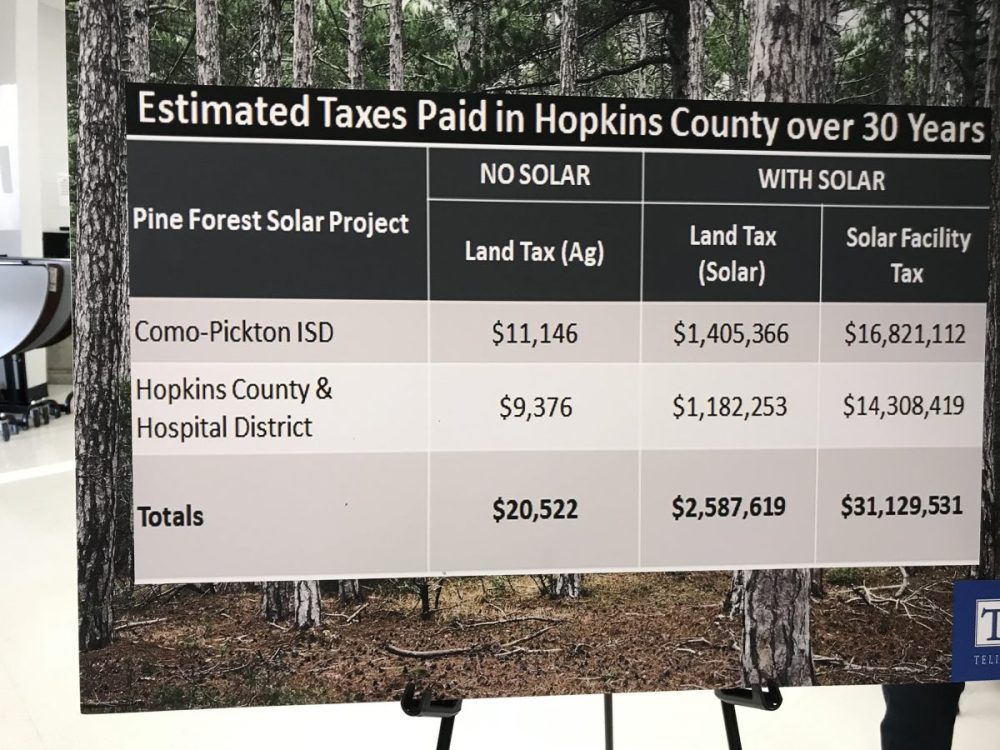

The Hospital District Board was asked to consider approving Chapter 381 economic development tax abatements for Hopkins Energy LLC and Pine Forest Solar I, LLC. The hospital district is the last of the local taxing agencies to consider granting a tax incentive to the solar farms. The county commissioners court and school districts’ board of trustees have all approved tax incentives for both solar projects.

The Pine Forest project is slated to get started in April and the other in mid-summer if all other required items and preparations move forward as proposed. In the past, tax abatements were for 100 percent. This left no impetus for the business receiving the abatement to provide certain information proving the terms required for the abatement were and continued to be met for the length of the agreement, EDC Executive Director Roger Feagley told the hospital district board.

The solar program would be for 30 years and would provide only two full-time employees who would be responsible for maintenance of the solar farm, including cleaning and replacing panels. The hospital would receive full tax on the appraised value for the last 20 years of the project, which would include some depreciation as the panels and equipment age.

Board member Joe Bob Burgin said he didn’t see the benefit of the agreement to the hospital; there are only two employees and only able to collect full appraised taxable amount after the project begins depreciating. He said he’d also heard there’d been a number of complaints from residents regarding solar farms in their neighborhoods.

Feagley said the main solar project to receive “push back” from the community was the proposed Arbala project.

A community meeting held at Como-Pickton school regarding the proposed Pine Forest Solar project was well attended. Only one family attended the meeting at Sulphur Bluff school and they indicated they were in favor of the the project.

Several community members attended a December 2019 public hearing at Sulphur Springs ISD regarding Solemio solar project in Arbala to voice concerns regarding the project. That is a more populated area, with more residences in the area. One measure proposed to address the concern that having a solar farm so close to properties would decrease values was to plant more trees between the panels and the homes, the EDC representative noted.

Burgin asked how much of the area around the proposed solar farms in Dike and Pine Forest is residential. Feagley noted that area is more sparsely populated, where the Arbala area is more heavily populated, just at the edge of town near a housing development.

Attorney Tommy Allison, talking earlier with Brown regarding the proposed agreement, had suggested a few minor changes, one stipulating action if property taxes are defaulted. There would be a 30 day period to allow the property owner to take care of it.

Land on which the farms are proposed currently is considered agricultural, but as the project progresses would be considered commercial. That would net more tax dollars than an agricultural property, it was noted.

Board member Chris Brown asked who would be responsible for paying the tax on the property if the solar plant is built. Feagley noted the property owners would, but it’s his understanding they were made aware of that before agreeing to let the land be used to put solar panels on.

Burgin expressed concern for property values of those living near solar farms, that it would cause their values to decrease.

Brown made the motion that both Chapter 381 Economic Development Tax Abatements be approved, provided the requested minor changes are approved, per the attorney and hospital.

The measure passed by a majority vote, with one vote against, granting the Chapter 313 agreement for the proposed Dike and Pine Forest solar farms.